Activity-based Costing Uses More Cost Than Traditional Costing.

Using activity-based costing calculate the appropriate activity rates. 200000250008 per customer call and.

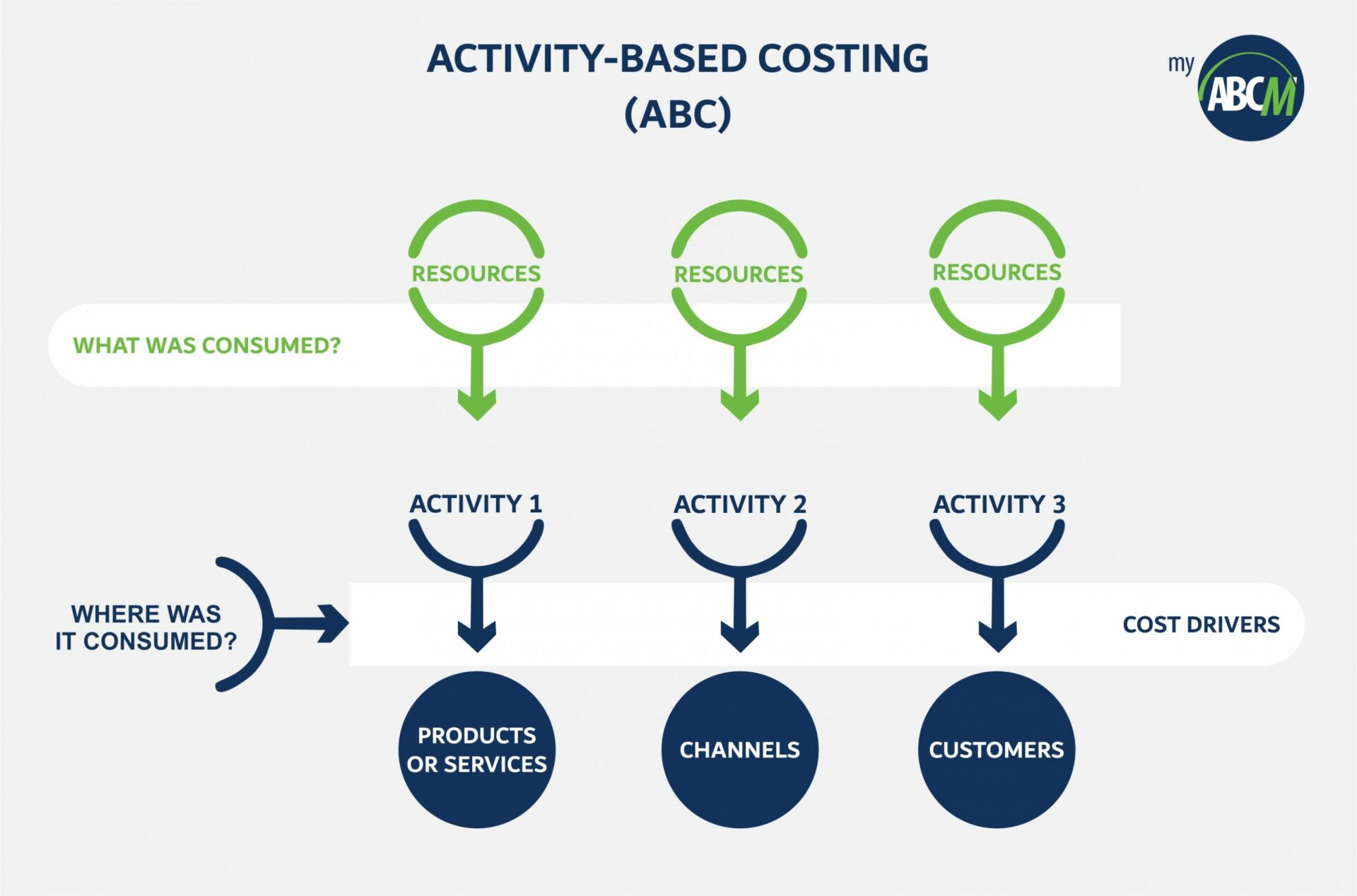

Activity-based costing is an accounting method where.

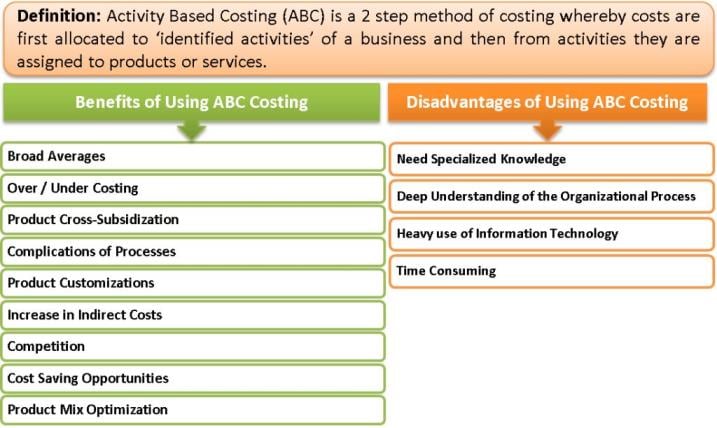

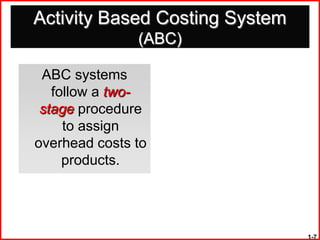

. Activity-based costing uses more cost drivers than traditional costing. Activity-based costing benefits the costing process by expanding the number of cost pools that can be used to analyze overhead costs. Companies move to Activity-Based Costing to better understand the true costs of goods and services.

Activity-based costing finds ways to divide or allocate these costs more proportionally or fairly in comparison to the traditional costing method. And product development hours. The overhead costs for the product are 200 or 20 times 10.

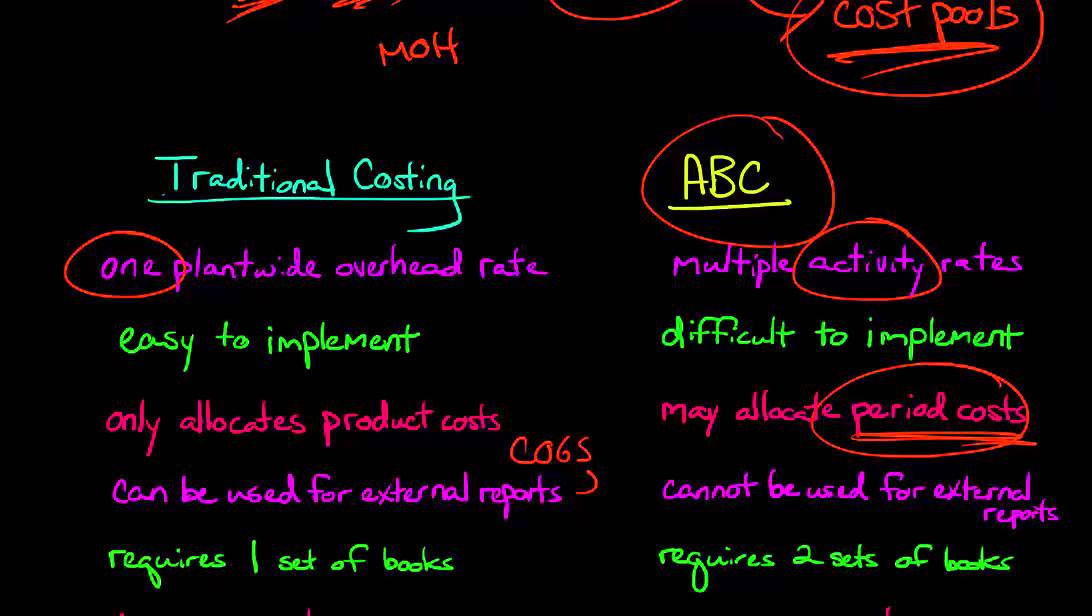

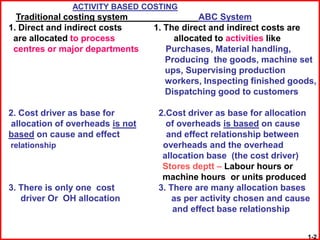

This guide will provide the job order costing formula and how to calculate it. The first difference between the two is that in traditional method cost objects and used up resources are used for evaluating costs whereas activity based costing relies on activities used by cost objects. The most commonly used systems to do so are activity-based costing and traditional costing.

Under traditional costing they are not. A companys total excepted overhead for the year is 500000. Smaller companies that have small overhead costs may find that using activity-based costing is not as efficient as other options.

A Activity-based costing uses a smaller number of cost pools than does organizational-based costing Relative to traditional costing methods activity-based costing is more concerned with identifying processes and less concerned with causal factors of overhead costs OC. Exactly one activity measure. One difference between ABC and traditional product costing is that when using activity-based costing organization-sustaining costs are assigned to products.

Organization-sustaining costs Individual customer revenues minus individual customer costs equals customer margin. Why is activity-based costing better than the traditional system of costing. Activity-based costing is a more specific way of allocating overhead costs based on activities that actually contribute to overhead costs.

Activity-based costing gives accurate costs figures whereas traditional costing reasonably. It helps to subside the limitation of a traditional method. Activity-based costing uses multiple costs for different activities whereas Traditional costing identical costs for multiple activities.

Andrade Filho Maia and Qassim 1997 found out that Activity-based costing ABC is being widely implemented as a substitute to traditional costing. And makes costly and non-value adding activities more visible allowing managers to reduce or eliminate them. It increases understanding of overheads and cost drivers.

The problem with Traditional costing is that it can easily over-allocate overhead to cost objectives. Activity-based costing removes the use of judgment from the allocation process D. You may most often find activity-based costing in the manufacturing industry.

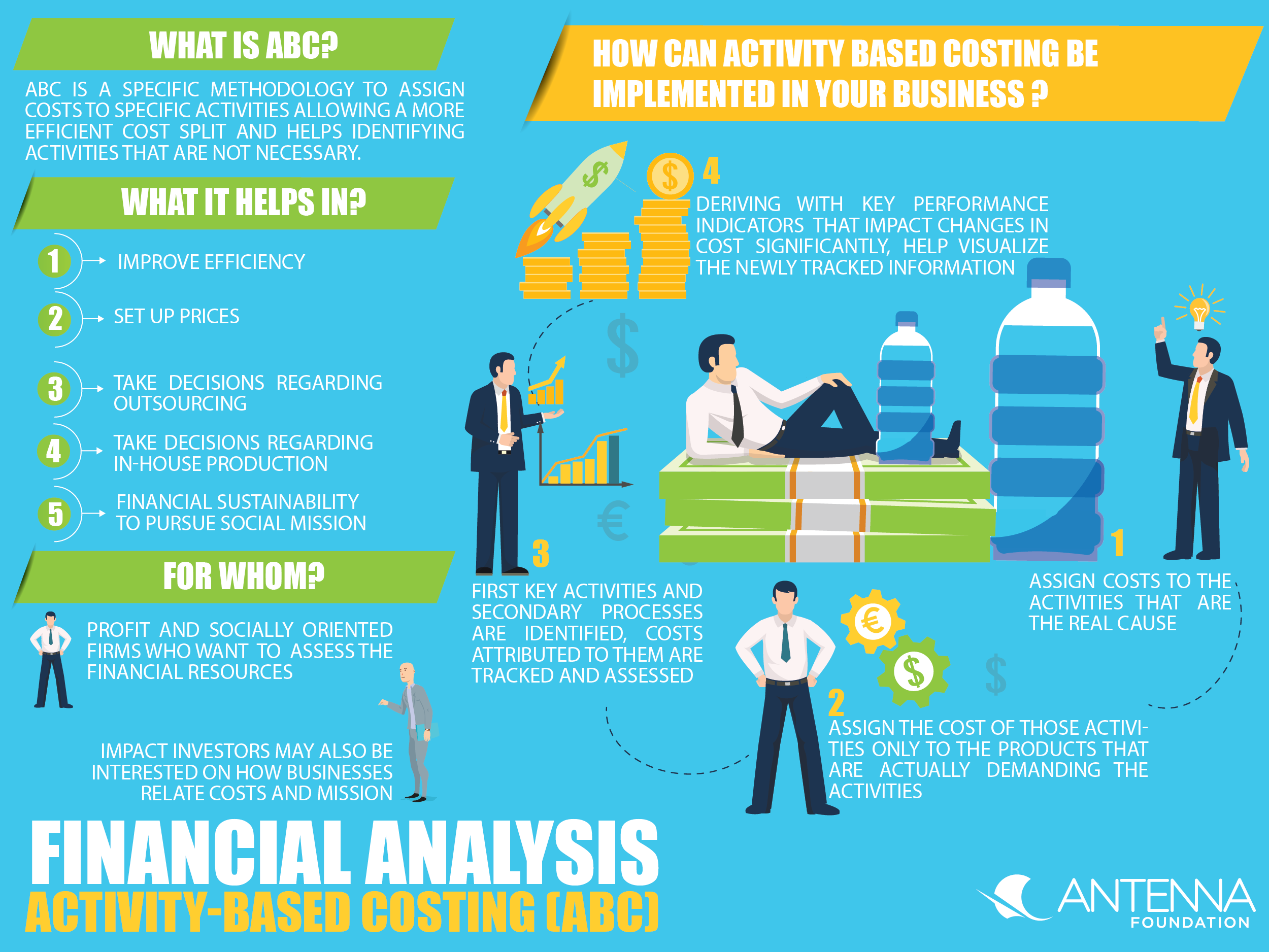

Activity-based costing is difficult to implement because it requires time and effort whereas traditional costing is easy to implement and straightforward. In Activity Based Costing the proper allocation of overheads is done which helps to find out the correct cost per unit of the product. Activity-Based Costing is a method to measure the performance and cost of activities in a system.

To put in the plainest of terms activity-based costing will set you back a few more dollars but it is easier to understand than traditional costing. A COVID-19 Must-Have Activity-based costing attempts to measure the costs of products and services more accurately than traditional cost accounting. Second traditional costing adds average overhead rate to the direct costs of products.

Activity-based costing provides a more accurate method of productservice costing leading to more accurate pricing decisions. The idea of an alternative costing system was initiated in the late 1980s by Robert Kaplan the first advocate for Activity-Based Costing. It is more accurate and reliable than traditional costing methods.

Electricity phone bills internet usage rent and even salaries are examples of costs that are more difficult to divide or allocate between units produced. This way you can write down a higher cost for units that use more. Unlike any traditional costing system ABC allocates cost to activities depending upon the utilization of resources and allocates.

It helps in a. But while traditional costing might be cheaper it may be less accurate than traditional costing. What is Activity-Based Costing.

They mentioned the cost of operations in an organization that are reflected by Activity-based costing ABC is more accurate and dependable compare to traditional costing. They are also more likely to use market-based costs when calculating data which doesnt always align with activity-based costing. Using activity-based costing calculate the appropriate activity rate.

An activity cost pool accumulates costs for. Activity based costing. 8 per customer call and 15 per development hour Activity rates are used to apply overhead costs to products and customers in the 1-stage allocation.

Traditional costing can only be used for the absorption of manufacturing overheads but activity based costing can effectively be used to allocate manufacturing as well as non-manufacturing overheads like selling administration etc. Traditional costing is production volume driven so its would be easy but yet inaccurate to assign a Skittles production with more overhead than say a the division within the same company that makes. Customer service with a total cost of 200000 and a total activity if 25000 customer service calls.

Which of the following types of costs are unaffected by which products are made during a period. This is because activity based costing considers the actual center of cost for the period cost and then allocates it. This costing methodology integrates the contributory relationship between activities of a system and its cost drivers.

Two activity cost pool have been identified. Job Order Costing Guide Job Order Costing is used to allocate costs based on a specific job order. His goal was to make use of more cost-drivers to lessen the errors and shortcomings of conventional costing methods Singer and Donoso 2008.

Activity Based Costing Everything You Need To Know About The Abc Methodology Myabcm

Pin On Flevy Marketplace For Premium Business Documents

Applying The Activity Based Costing Abc Model Magnimetrics

Activity Based Costing Abc Explanation Advantages And Tips Toolshero Financial Management Activities Abc

Difference Between Traditional Costing And Activity Based Costing Which Is Better Finlawportal

Activity Based Costing Ppt Video Online Download

Activity Based Costing Benefits Disadvantages Of Using Abc Costing

Abc Questions Activity Based Costing Questions And Answers Prepared By Bigeso Makenge Pgda Studocu

Financial Analysis Activity Based Costing Sswm Find Tools For Sustainable Sanitation And Water Management

Activity Based Costing Vs Traditional Steps Results Compared Activities Cost Abc

Mahima Majethia This Video Explains Activity Based Costing In 3 Minutes Which Is Very Easy To Understand The Person Give Managerial Accounting Abc Activities

Abc Accounting Model Visual Charts Ppt Template Of Activity Based Costing Presentation Business Budget Template Bookkeeping Templates Abc Activities

Activity Based Costing Vs Traditional Costing Youtube

Mcgraw Hill Irwin Copyright C 2008 By The Mcgraw Hill Companies Inc All Rights Reserved Supplementary Slides Activity Activities Cost Accounting Abc Does

Difference Between Activity Based Costing And Traditional Costing With Table Ask Any Difference

Abc Accounting Model Visual Charts Ppt Template Of Activity Based Costing Presentation Accounting Cost Accounting Presentation Deck

Comments

Post a Comment